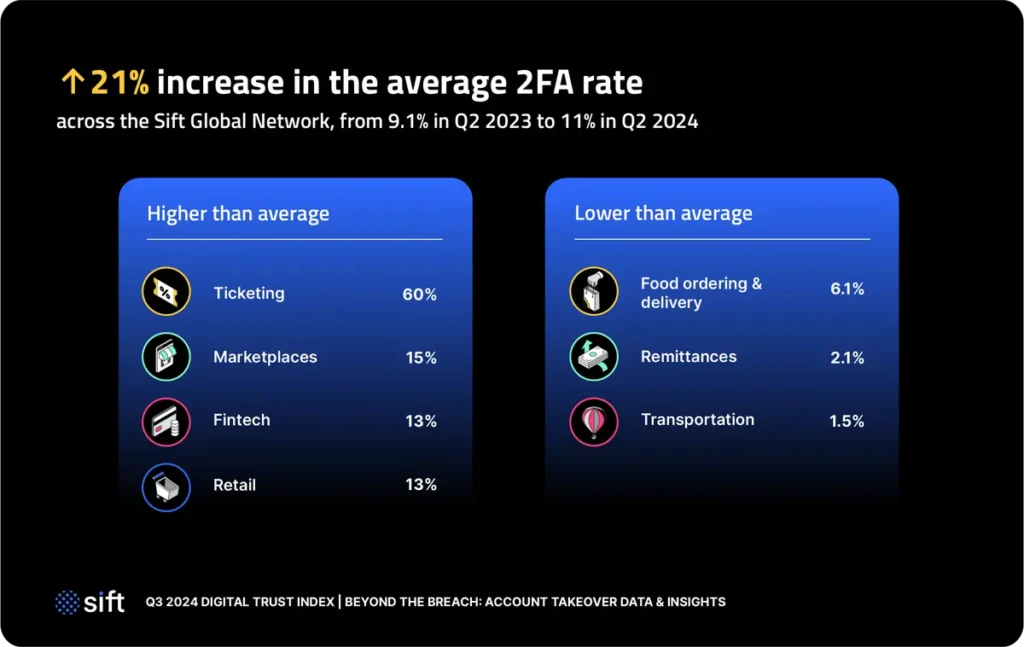

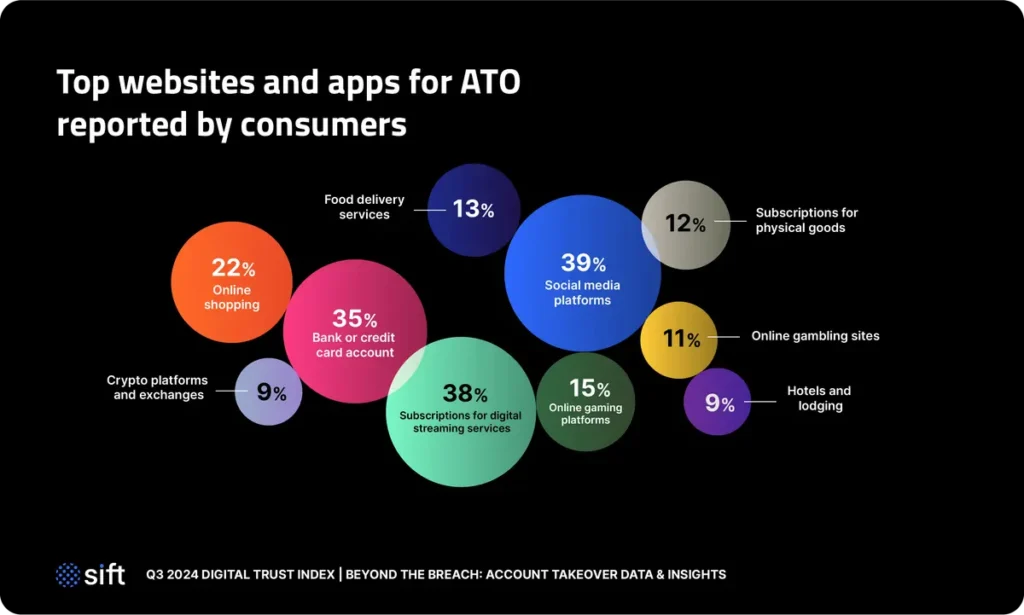

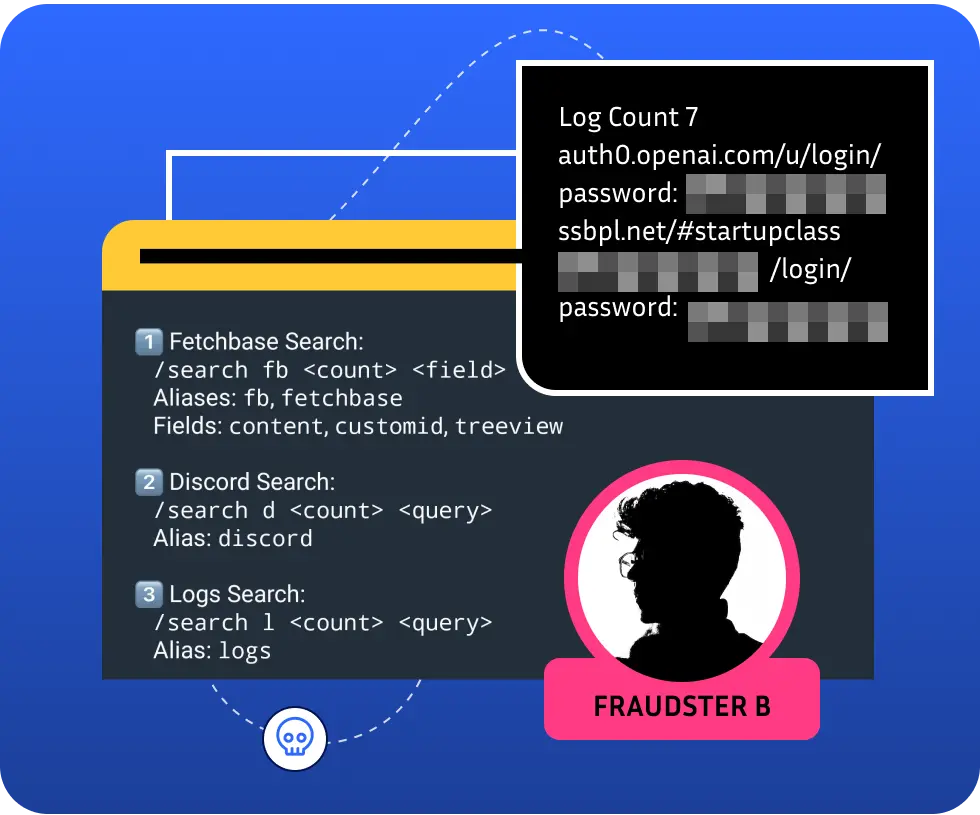

Security breaches and account takeovers (ATOs) are making headlines this year. High-profile incidents, like the massive data breach of 2.9 billion records, the Ticketmaster data hack, scams following the CrowdStrike outage, and the rise of AI-generated deepfakes, all underscore the widespread consequences of this growing threat.

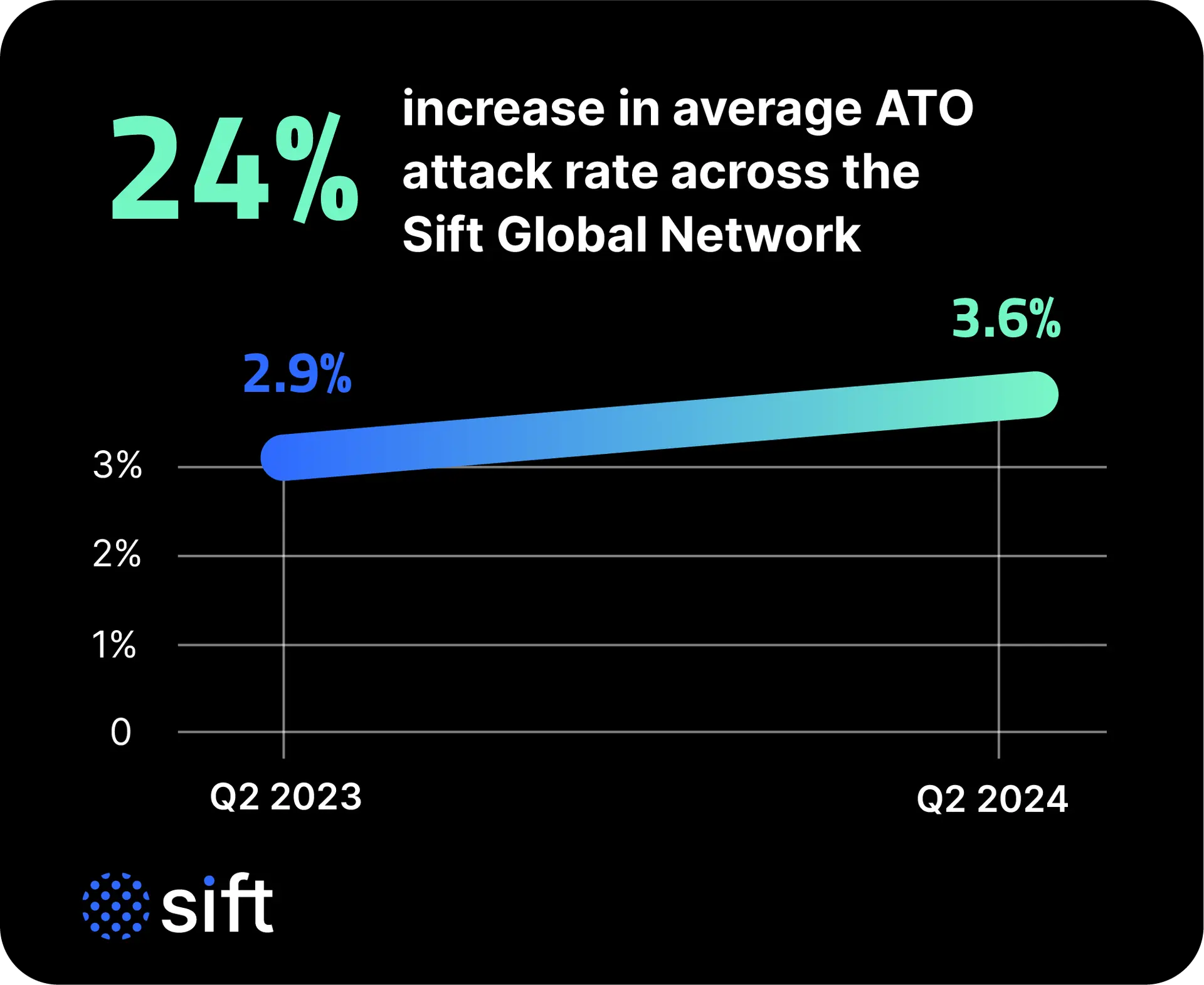

ATO has proven to be an increasingly costly issue. In 2023 alone, account takeover fraud resulted in nearly $13 billion in losses, up from $11 billion in 2022. This form of fraud results in the unauthorized access of accounts using stolen credentials obtained from data breaches, phishing attacks, and malware to make fraudulent transactions, steal sensitive information, or launch further attacks. Given the expanding scope and rising costs associated with ATO, prioritizing account security and safeguarding digital trust is both expected by consumers and made more difficult with every data breach.