What’s New from Sift

Harness the power of a platform that continuously evolves.

Latest Innovations on our AI-Powered Platform

Deploy Defenses in Minutes with Simpler Tools & Smarter Investigations

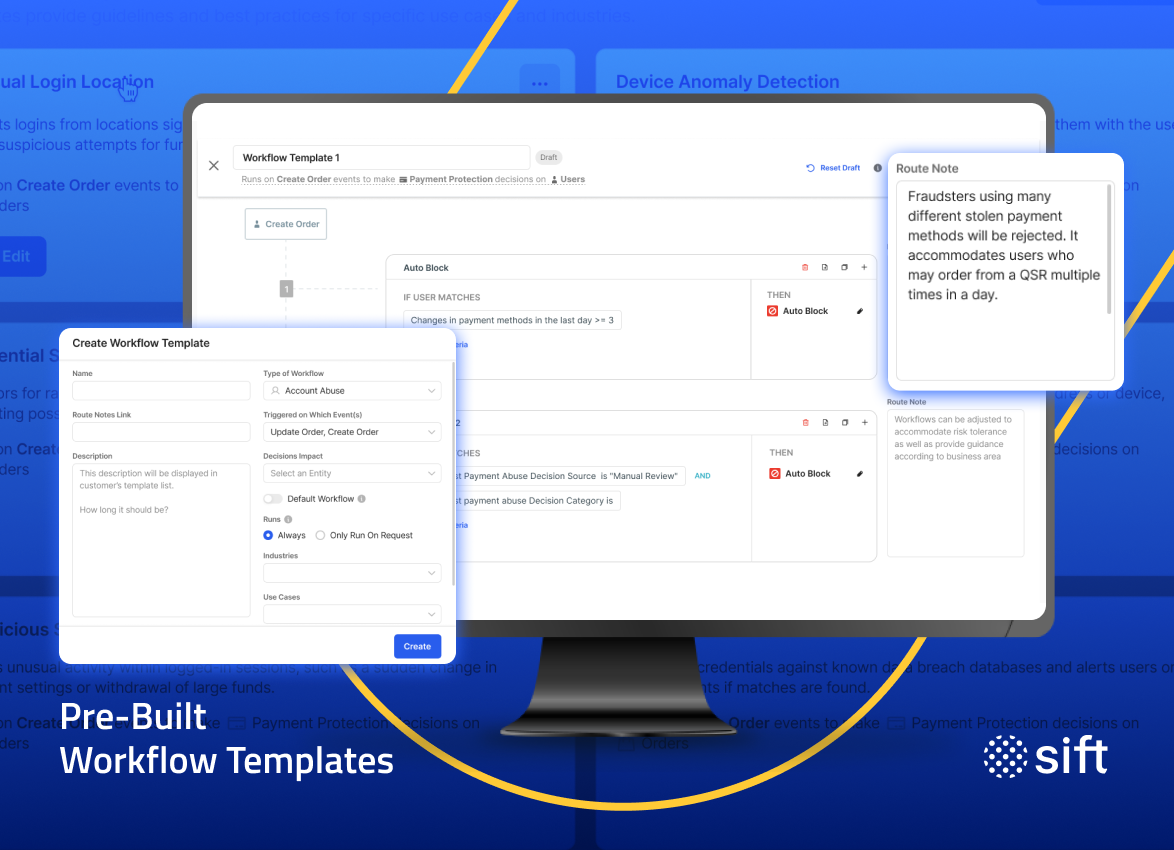

Pre-Built Workflows for Day One Protection

THE SOLUTION

Fraud workflows are critical, but building them from scratch can slow down protection and leave gaps attackers can exploit. With Pre-Built Workflow Templates, risk teams can launch payment protection in minutes without engineering support.

HOW IT WORKS

Teams get access to a library of ready-to-use templates that deliver faster time-to-value, reduce workloads, and put proven fraud strategies to work from day one. Each Pre-Built Workflow Template distills proven strategies into actionable playbooks for fine-tuned accuracy and decisioning, increasing operational efficiency instantly and over time.

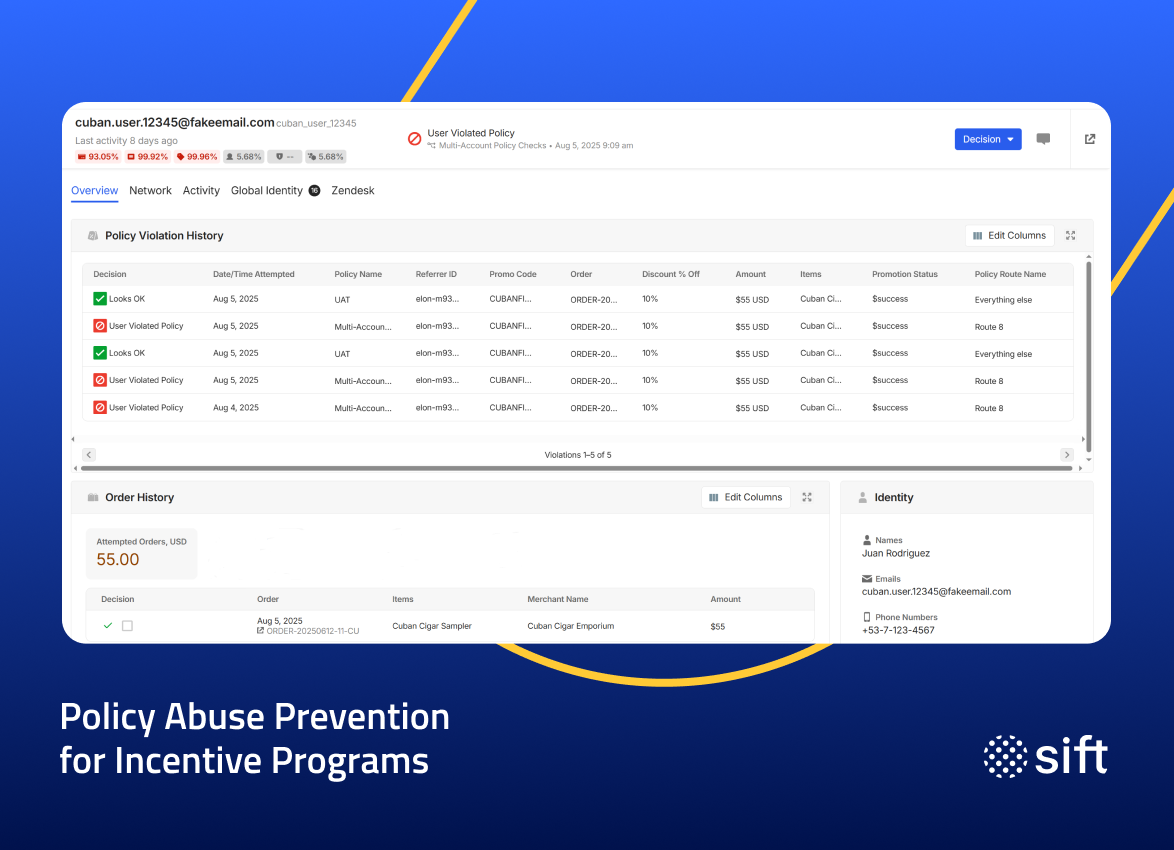

Policy Abuse Protection That Stops Margin Erosion

THE SOLUTION

Policy abuse—whether loyalty fraud, promo exploitation, or referral abuse—often goes unseen until it’s already eroding revenue. With Specialized Console Functionality for Incentive Abuse, fraud teams can prevent multi-account fraud, fake account creation, and incentive abuse before the damage is done.

HOW IT WORKS

The new Console experience equips teams with a suite of incentive-focused defenses designed to expose sophisticated abuse patterns, measure their financial impact, and take swift action against repeat offenders. By making it easier to uncover and respond to incentive abuse, this release strengthens margins, lowers acquisition costs, and reduces the need for manual review.

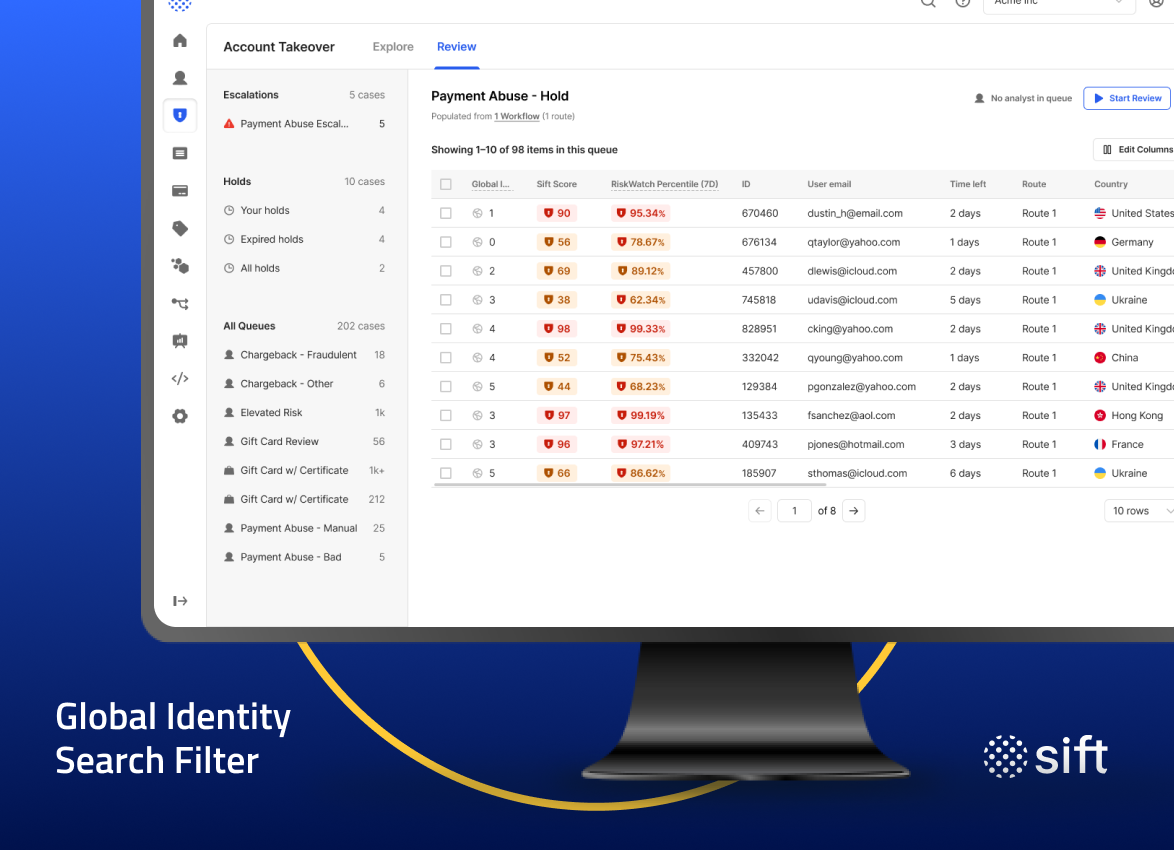

Faster Investigations with Expanded Visibility

THE SOLUTION

Fraud investigations demand speed and context. The Fall ’25 release expands visibility across fraud operations, giving teams a clearer view of high-risk activity and enabling them to act with greater confidence.

HOW IT WORKS

New capabilities accelerate the process of surfacing hidden connections, reviewing historical data, and tracking account takeover trends in real time. Historical chargeback imports make it possible to feed past data directly into Sift’s models for more accurate detection.

Global Identity Search Filters allow analysts to pinpoint linked accounts and reveal coordinated activity faster than ever, and the updated ATO Overview Dashboard provides a clear view of login behaviors, with drilldowns highlighting 2FA usage, as well as notification-based logins for more precise defense improvements.

Explore More Innovations

ADVANCED FRAUD INTELLIGENCE & OPERATIONAL EXCELLENCE

ActivityIQ is a GenAI fraud research assistant that summarizes user actions across sessions in seconds, helping teams spot high-risk activity faster and reduce investigation time. FIBR-In-Console delivers instant benchmarking by showing company metrics side-by-side with industry and global fraud rates. With Automatic Chargeback Labeling and smarter Console upgrades, analysts gain sharper accuracy, less manual work, and faster day-to-day operations.

FIBR In-Console: Fraud Benchmarking at Customers' Fingertips

FIBR in-console makes it easier for customers to gain a deeper understanding of fraud performance relative to industry and global benchmarks. Now, a company’s unique chargeback and block rates are pre-populated right alongside FIBR data directly within the Sift Console, offering a clear, side-by-side view of attack rates and vertical-specific insights.

Fraud Decisions with Dimension Through Identity Trust XD

Identity Trust XD shifts fraud prevention from stand-alone risk signals to context-based decisioning to reveal the full story behind every user, execute more confident fraud investigations, and accelerate speed-to-trust for every decision. Powered by the Sift Global Data Network, which processes over 1 trillion events annually, Identity Trust XD links user activities across various digital touchpoints, industries, and geographies to deliver a comprehensive understanding of every identity.

Precise, Powerful Insights & Unified Account Takeover Operations

Sift’s enhanced ATO solutions combine identity-centric accuracy, real-time behavioral analysis, and device fingerprinting to detect account takeover fraud faster and more precisely, eliminating data gaps and delayed response. With seamless CIAM integrations, fine-tuned MFA controls, and pre-built automations, businesses gain actionable insights and unified workflows that prevent a median of up to $4.2 million per year in fraud losses per customer.

ThreatClusters

ThreatClusters is a revolutionary approach to AI-powered risk decisioning that uses a multi-pronged method, combining the precision of customer-specific risk models with the broader intelligence of a global model, in order to derive risk signals that are unique to each industry. ThreatClusters can improve fraud decision accuracy, reducing the risk of false positives/negatives up to 20% by fine tuning risk models to incorporate the real-time behavior traits of a cohort of peers, in addition to new-to-cohort fraud patterns.

RiskWatch

RiskWatch makes it possible to set target block rates that automatically adapt in response to changes in user behavior, fraud attacks, or other dramatic shifts. RiskWatch automatically accounts for changes in user behavior patterns in real time, during fraud attacks or other dramatic shifts, with block rates adapting to capture additional risky events as they occur. As attacks conclude, risk thresholds return to pre-fraud levels that can be easily adjusted. RiskWatch is immediately available for Sift customers that leverage Sift for account creation, account takeover, content, payment, policy, and chargeback fraud.

FIBR | Fraud Industry Benchmarking Resource

FIBR is the first-of-its-kind Fraud Industry Benchmarking Resource showcasing real-world data benchmarks for payment fraud and account takeover. See how your digital risk strategy stacks up against others in your market, and get essential insights into fraud trends emerging across Sift’s Global Network.

Sift Patents

With 40+ patents and counting, we’ve diligently documented our matchup against digital fraud, building an ongoing source of trust for every business in our network.

Dare to grow differently.

Flip the switch on fraud-fueled fear. Make risk work for your business and scale securely into new markets with Sift’s AI-powered platform.