Navigating the Next Generation of Payment Fraud

Discover the latest payment fraud data, consumer insights, and emerging trends in the Q1 2024 Digital Trust & Safety Index.

Current Trends in Payment Fraud

Merchant losses due to payment fraud reached $38 billion in 2023, and are expected to soar to a total of $362 billion by 2028. The start of 2024 brings increased economic pressure to both consumers and businesses, driven by persistent inflation and high interest rates.

Economic anxiety has led to a shift towards value-seeking behavior, with shoppers preferring to purchase cheaper goods and services and “dupes” over premium brands. The macroeconomic backdrop is expected to remain unpredictable, with global events creating turbulence and increasing the likelihood of scams—many of which could be upleveled by generative AI.

As consumer spending habits evolve and fraud becomes more advanced and nuanced, businesses must uplevel their fraud decisioning, and operations as a whole, in order to grow fearlessly.

Payment Fraud Increases Across Key Verticals

Attempted payment fraud rose significantly across a variety of verticals year-over-year in 2023 across the Sift network. Fraudsters are turning their focus to high-velocity transactions in rapid-growth industries like iGaming, ticketing, and food & delivery in the hopes of staying undetected.

Highest Fraud Rates Among Payment Types

Among the most used digital payment types, gift cards and prepaid cards have notoriously high fraud rates. These reloadable cards are easy to purchase with stolen funds and make purchases that are difficult to trace.

Payment Fraud Attack Rates for Top Card Issuers

Some card issuers have higher rates of attempted payment fraud than others in the Sift network. These card networks offer $0 liability protection, meaning payment fraud victims won’t be on the hook for the unauthorized purchases. Instead, the liability shifts for card-not-present (CNP) transactions to the merchant.

How Consumer Buying Behavior Impacts Payment Fraud

Dealing with fraudulent transactions is now a commonplace experience, with nearly half of consumers surveyed* by Sift saying they’ve been a victim of payment fraud in the past year and a half. Consumers with higher income were targeted at a higher rate, indicating that fraudsters do their research and follow the money. The majority of these instances happened on online shopping sites, in line with the sharp increase in e-commerce fraud in the last year.

43% of consumers have been a victim of payment fraud at least once in the past 18 months.

Percent of Payment Fraud Victims by Annual Income Level

39%

46%

51%

The Next Generation of Payment Fraud

Online shopping habits vary greatly by generation. Thirty-two percent of Gen Z consumers shop online at least once daily, compared to 25% of millennials, 15% of Gen X, and 7% of baby boomers. Gen Z is also the most likely to shop for secondhand items online, with 42% of this generation purchasing a resale item in the past year.

Younger Generations are Getting Closer to Fraud

Gen Z is the most likely generation to: have someone they know make unauthorized transactions with their payment credentials; personally participate in payment fraud or know someone who has; and finally, see offers to participate in fraud online. These findings bolster previous Sift research, finding that nearly half (42%) of Gen Zers admit to engaging in first-party fraud, or filing a fraud dispute for a transaction they made even though they received the item and were satisfied with their purchase.

of payment fraud victims indicated the incident was committed by someone they knew.

- Gen Z: 28%

- Millennial: 25%

- Gen X: 13%

- Baby Boomers: 2%

of consumers know someone who has, or have personally, participated in payment fraud.

- Gen Z: 33%

- Millennial: 25%

- Gen X: 14%

- Baby Boomers: 10%

of consumers have seen offers to participate in online fraud.

- Gen Z: 34%

- Millennial: 20%

- Gen X: 11%

- Baby Boomers: 9%

Breaking Down the Generational Divide in Preferred Payment Types

There’s a distinct divide between baby boomers and Gen X compared to millennials & Gen Z when it comes to their most frequently used payment methods for online purchases. Younger generations are generally using credit cards less, largely due to racking up credit card debt over the course of the pandemic and being less trusting of traditional financial institutions. Millennials and Gen Z are also about 48% more likely than baby boomers and Gen X to choose digital wallets as their preferred payment type when shopping online.

Generational Use of Digital Wallets

Millennials and Gen Z are 48% more likely to use digital wallets as their preferred payment type.

Gen Z is Redefining the Customer Experience

Consumerism has a different meaning for Gen Z, who value having unlimited access to goods and services—such as car-sharing, video streaming, subscriptions—over owning them. Gen Z is driven by their distrust of capitalism, making them less likely to view stealing from large corporations as immoral. At the same time, Gen Z expects speedy, streamlined user experiences and will quickly abandon a brand that doesn’t deliver.

The generation’s hyper-reliance on the internet also means they’re seeing more fraud-as-a-service opportunities on social sites, making it easier for these digital natives to participate in fraudulent activity. This convergence of Gen Z consumer behavior and exposure to fraud further the democratization of fraud, increasing the accessibility and ease with which anyone, regardless of technical experience, can engage in fraudulent activities.

“We’ve found that younger generations, particularly Gen Z, are not only more susceptible to fraud, but are also participating in fraudulent activities at a higher rate. Gen Z's unique consumer behavior, driven by a preference for experiences over physical goods, along with increasing fraud, creates a complex environment for businesses to navigate.”

Rebecca Alter

Trust & Safety Architect at Sift

AI-Fueled Fraud is Scaring Away Customers

The Impact of AI on Payment Fraud

Advancements in generative AI have had a significant impact on the success and scale of scams. Fraudsters are increasingly turning to deepfakes to trick consumers and businesses into disclosing payment or account credentials by impersonating a trusted individual. And these deepfakes are making the scamming process faster, more realistic, and capable of bypassing KYC checks thanks to the accessibility of AI generators. This is bringing on a new wave of digital identity or “identity hijacking” in which fraudsters are recreating consumers’ digital likeness for fraudulent use.

These nefarious applications of AI-generated content are having a real impact on businesses. A study conducted by Liminal found 98% of respondents identified AI-enabled fraud attacks as significantly impacting the level of fraud their businesses have encountered over the past two years. It’s also causing consumers to shop online less frequently due to the fear of AI threats.

Payment Fraud Leads to Brand Abandonment

Consumers Deny Personal Responsibility for Fraud

Business Responsibility in Preventing Payment Fraud

Payment fraud not only has financial consequences for businesses, but can also damage consumer sentiment towards them. Over three-quarters of consumers said they’d stop shopping on a site if their payment credentials were used for unauthorized purchases. And in the event the fraudulent transactions go through, the majority believe it should be the business or financial institution who should be liable.

Grow Beyond Payment Fraud

Digital businesses are facing a hyper-complex and nuanced Fraud Economy. As fraud signals evolve alongside shifting consumer behavior, it’s becoming increasingly difficult to differentiate between trusted and risky users. More consumers may exhibit both legitimate and suspicious online actions—underscoring the need for sharpened visibility as fraud shapeshifts.

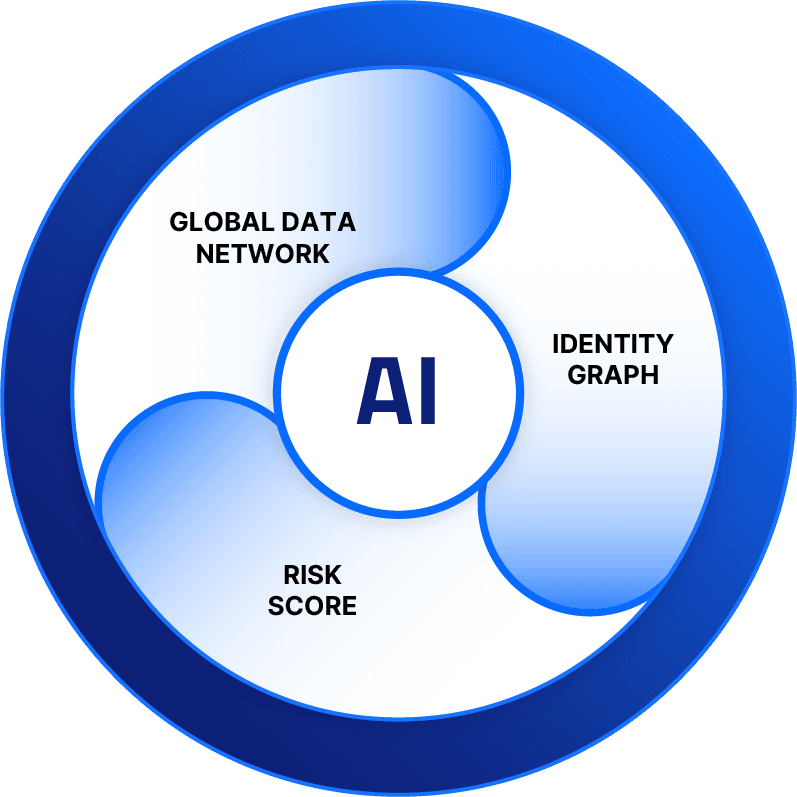

AI-fueled fraud tools are the key to enabling next-level consumer experiences. Sift’s AI-powered platform transforms fraud prevention into a competitive advantage for businesses and customers. Dependable user-level insights allow you to activate growth with increased acceptance rates for trusted customers while proactively detecting risk and emerging fraud rings.

Sift’s payment fraud solution shifts the focus from risk to revenue, cutting the profit-to-loss ratio through patented technology, Clearbox Decisioning, and on-demand expertise. Clearbox Decisioning provides deep, user-level transparency into why and how risk thresholds are set. This magnified visibility into user behavior and fraud risk translates into sharper, smarter decisions that help businesses confidently evolve and expand into new opportunities and markets. Our deep investments in machine learning and user identity, a data network scoring 1 trillion events per year, and a commitment to long-term customer success, empower more than 700 customers to grow fearlessly.

“Navigating the landscape of payment fraud requires businesses to stay vigilant and adapt to evolving threats. With the right data, tools, and strategies in place, businesses can grow and succeed even in the face of rising payment fraud.”

Move Your Business Forward With FIBR | Powered by Sift

Sift’s one-of-its-kind Fraud Industry Benchmarking Resource lets you compare your payment fraud, fraudulent chargeback, and manual review rates against Sift benchmarks by industry and region.

*On behalf of Sift, Researchscape International polled 1,052 adults (aged 18+) across the United States via online survey in February 2024.