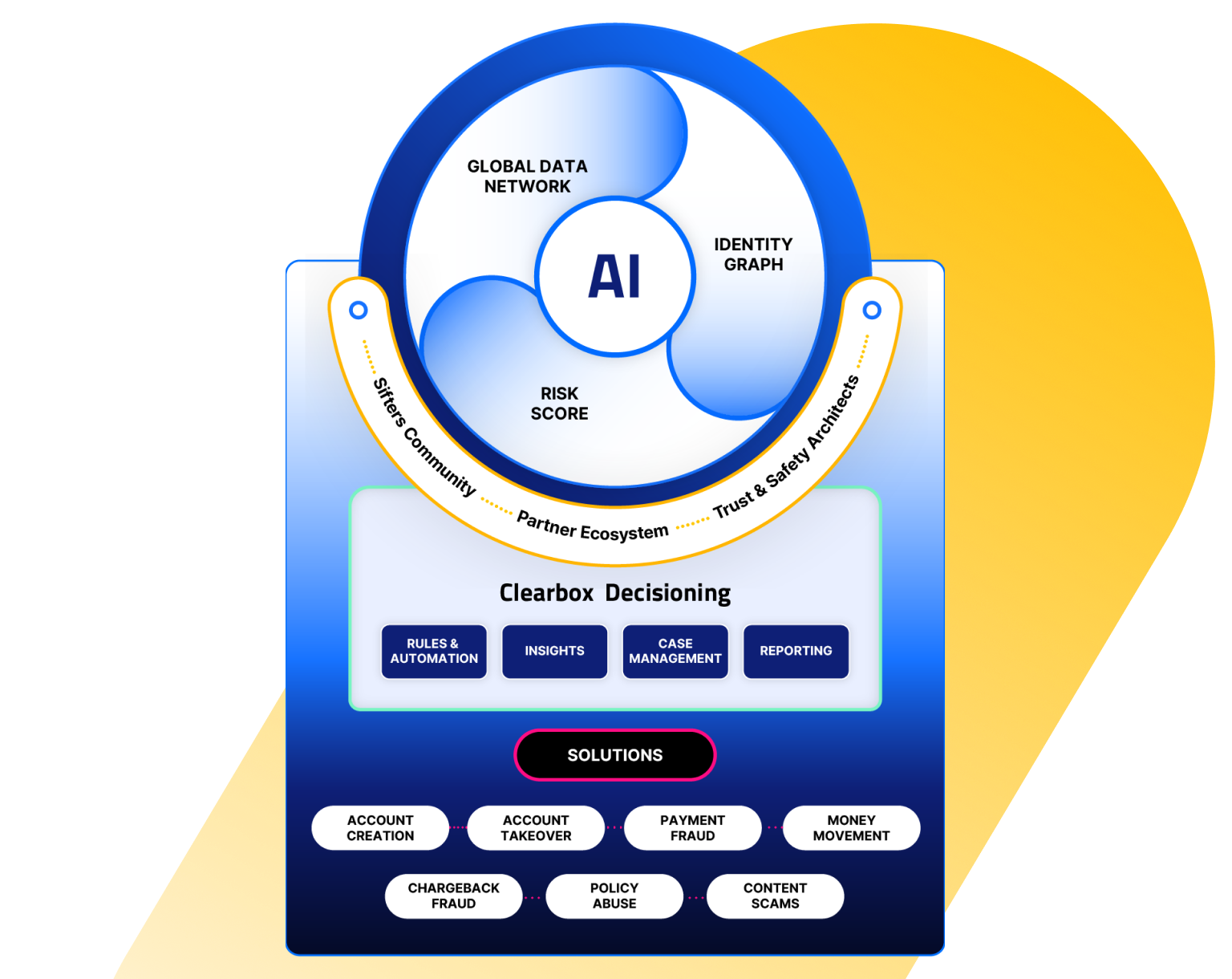

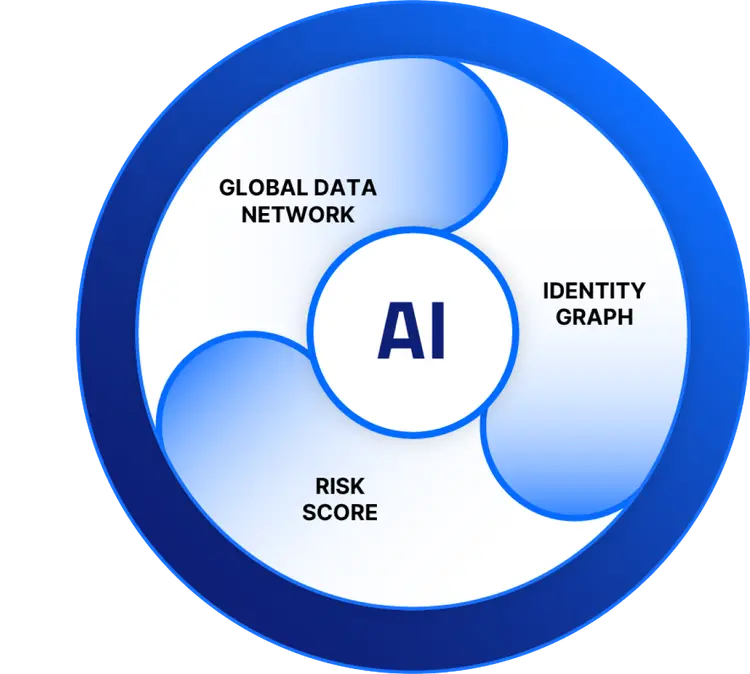

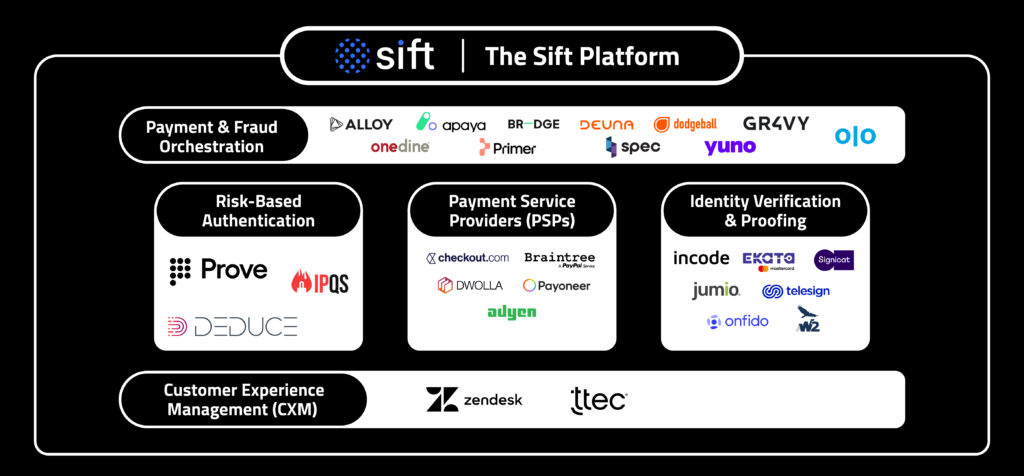

Do more with data than ever imagined. The Sift Platform utilizes a rich and tenured global data network with accessible and impactful decisioning tools.

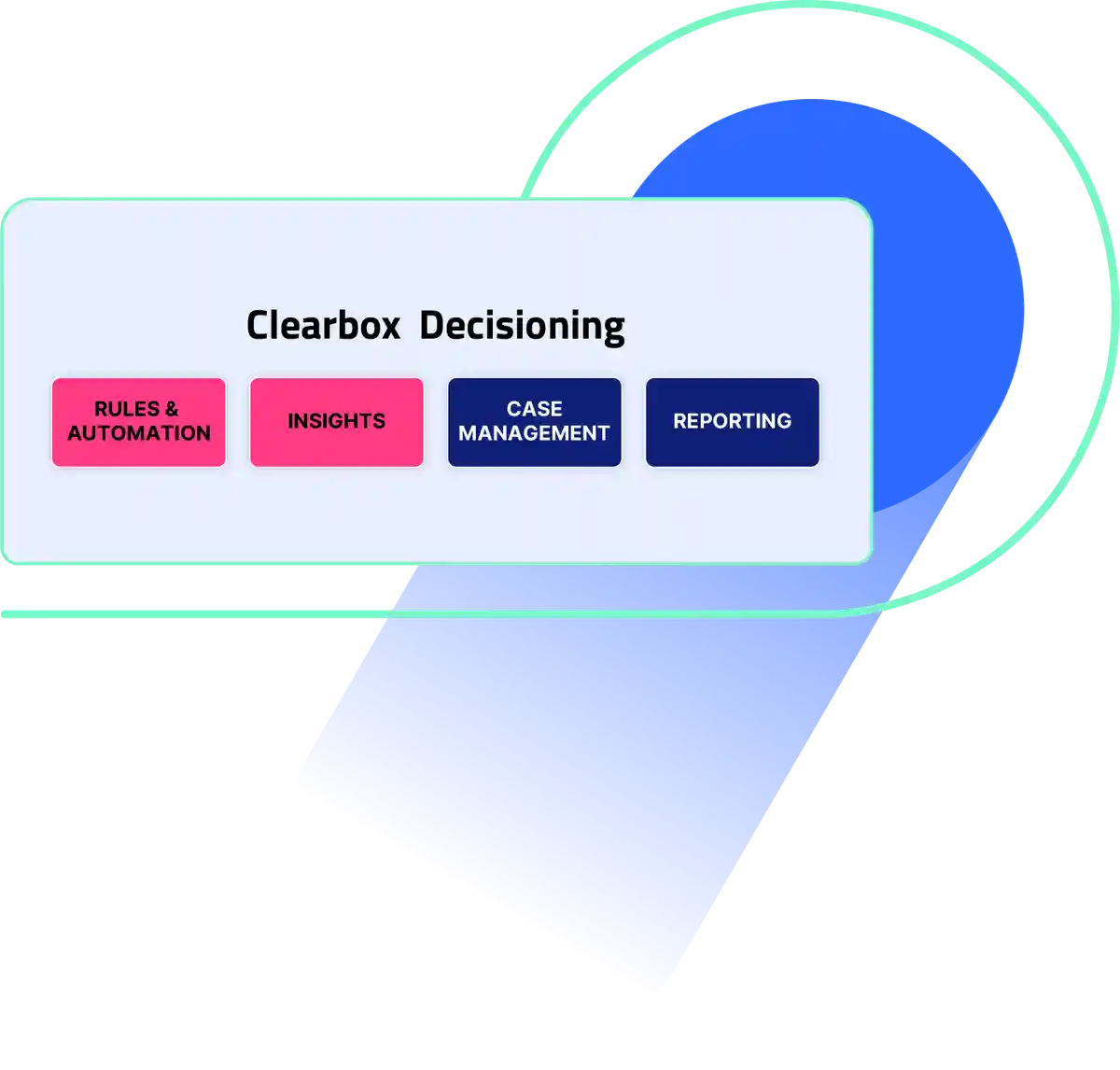

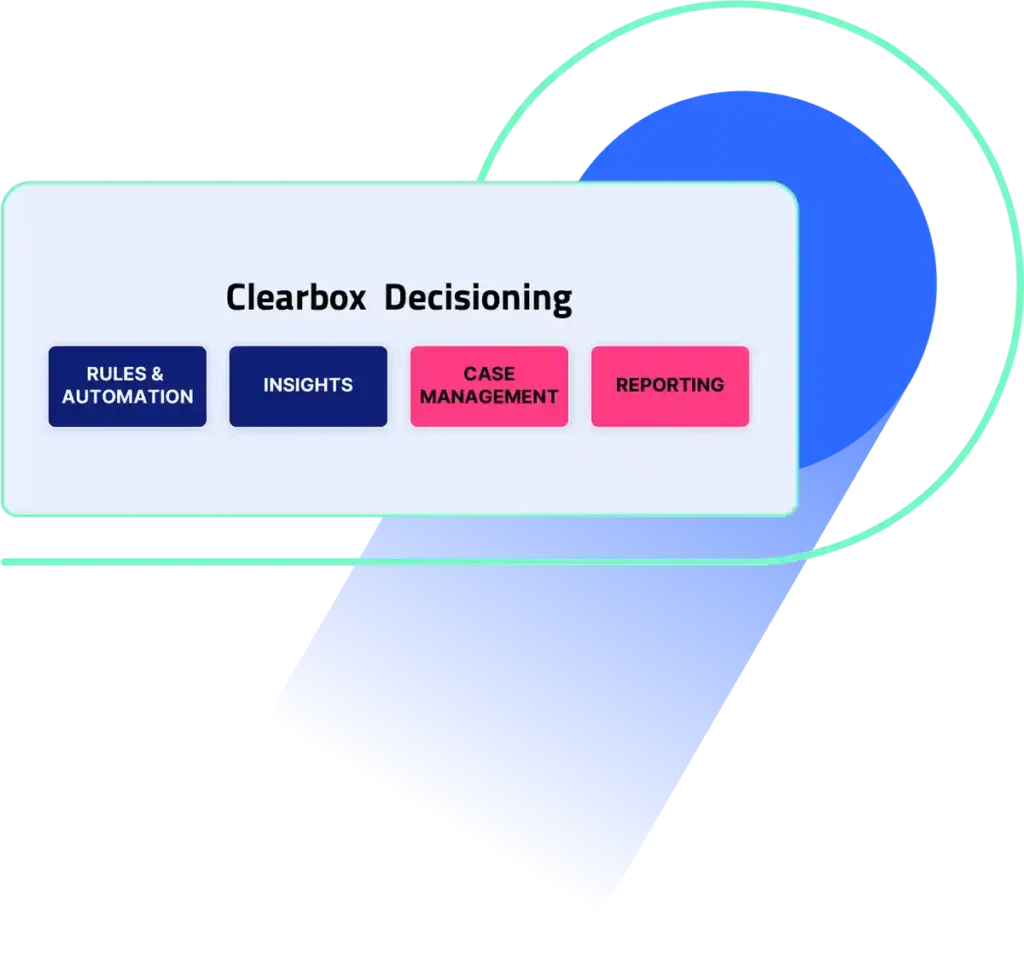

Unprecedented user insights are combined with advanced automation capabilities along with access to a community of fraud experts that helps pinpoint new opportunities of growth at each step of the customer journey.

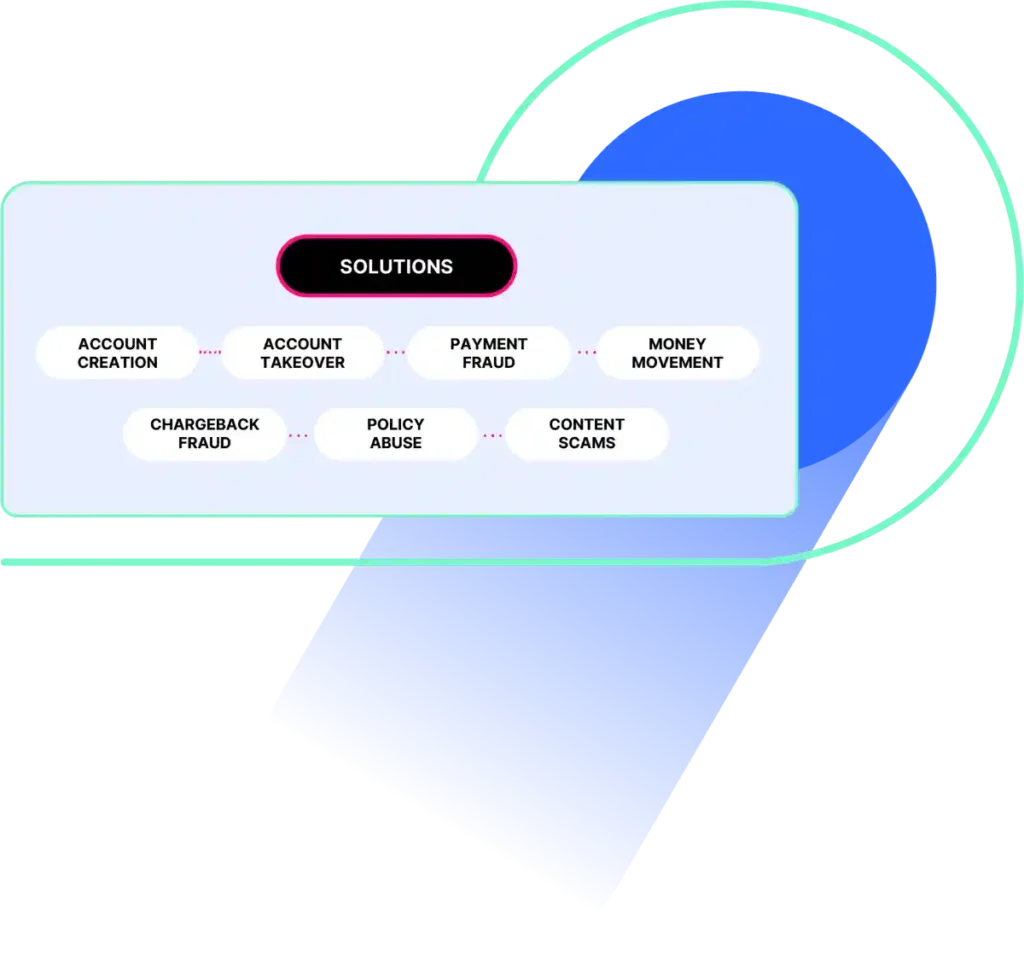

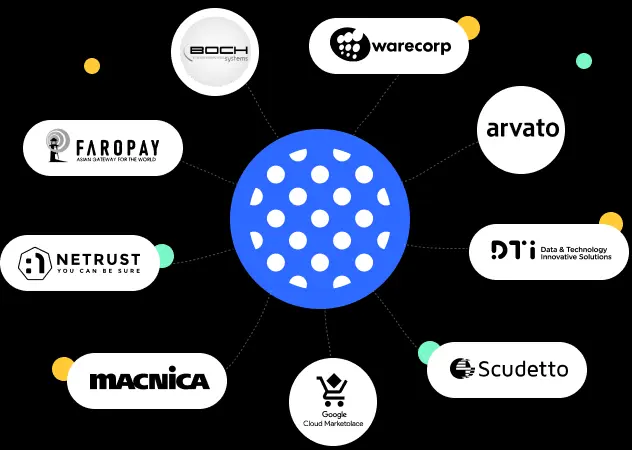

Multiple solutions. One platform. Countless opportunities to grow fearlessly.